Capital Markets Playbook | Q1 2022

2021 Q4 Summary

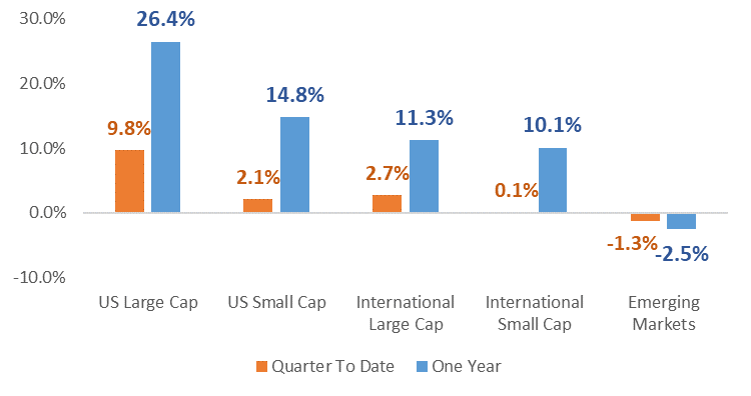

- U.S. Large Cap equities led broad-based equity markets in the fourth quarter of 2021 despite investor concern over tighter monetary policy, lingering supply chain disruptions and the emergence of the omicron variant.

- U.S. Large Cap equities posted gains of nearly 10% for the final quarter and finished the year up more than 26%.

- U.S. Large Cap stocks outperformed all other major equity markets, including U.S. Small Cap, International and Emerging Market equity.

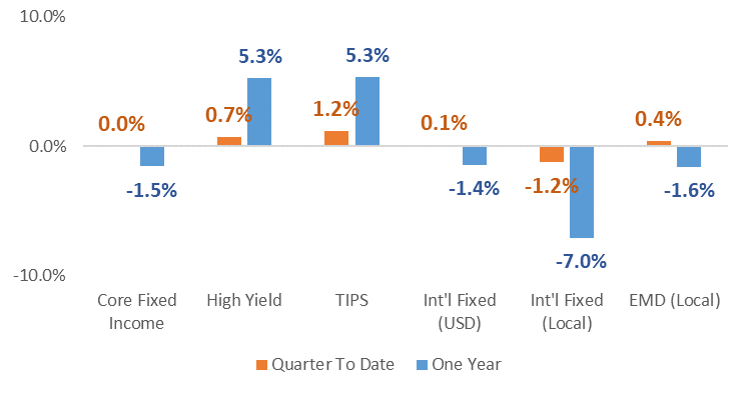

- Fixed Income markets finished 2021 on a volatile note as investors began to price in more aggressive central bank monetary policy.

- Core Fixed Income was flat in the fourth quarter and finished the year down about 1.5%.

- High Yield Fixed Income and TIPS were the only major fixed income asset classes that posted positive returns in 2021.

Equity Market Performance

Fixed Income Market Performance

Macroeconomic Outlook for the Next 6-12 Months

- Economic Growth

- Economic activity in the U.S. will decelerate in 2022.

- U.S. economic growth in 2022 will not be as strong as it was in 2021, but a substantial slowdown or recession is unlikely.

- The global economic rebound will continue at an uneven pace.

- In the developed world (Europe and parts of Asia), economic growth is expected to moderate as well.

- Growth prospects in the developing world (i.e. Emerging Markets) are more uncertain since these countries have different approaches to mitigate the pandemic. That said, Emerging Market economies stand to gain the most as the pandemic begins to evolve into an endemic.

- Economic activity in the U.S. will decelerate in 2022.

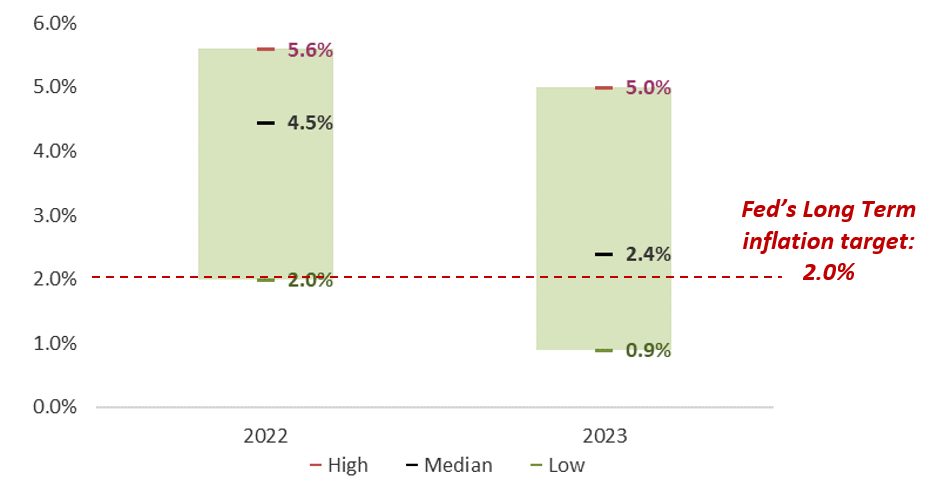

- Inflation

- Expect inflation to moderate in 2022 but remain above the Federal Reserve’s 2% target through 2022.

- While some supply constraints may linger, many of the supply chain issues that spooked markets in 2020 and 2021 will begin to moderate by mid-2022.

- Strong demand for certain goods and services over the summer months are likely to impact certain industries more than others (travel, hospitality and entertainment are likely to see very strong excess demand over the spring and summer months of 2022).

- Labor market supply is likely to improve in 2022 as workers reenter the workforce. Upward pressure on wages is likely to moderate by the end of 2022.

- Interest Rates

- The Fed will likely end its tapering program by March 2022, setting the stage for interest rate hikes.

- The Fed may raise interest rates several times in 2022, but short-term interest rates will remain well below pre-pandemic levels.

Market Outlook for the Next 6-12 Months

- Equities

- Equity market volatility in the U.S. is likely to be higher than normal as tighter monetary policy, inflation and COVID-19 continue to create uncertainty for investors.

- International and Emerging Market stocks are “cheap” relative to U.S. stocks. These sectors are set to outperform as global economies continue to recover from COVID-19 induced shutdowns.

- Value stocks in the U.S. are cheap relative to growth stocks and may outperform as interest rates move higher.

- Fixed Income

- The Fed’s monetary policy activities will create volatility in fixed income markets in 2022.

- The Fed’s tapering program will push intermediate and long-term interest rates higher, putting pressure on longer duration fixed income returns.

- The Fed will also be raising short-term interest rates in 2022, meaning that short duration fixed income yields will move higher.

- High Yield fixed income is expensive on a historical perspective and may see selling pressure as the Fed’s monetary policy tightening program progresses.

2022 Theme: The Pandemic Begins to Evolve Into An Endemic

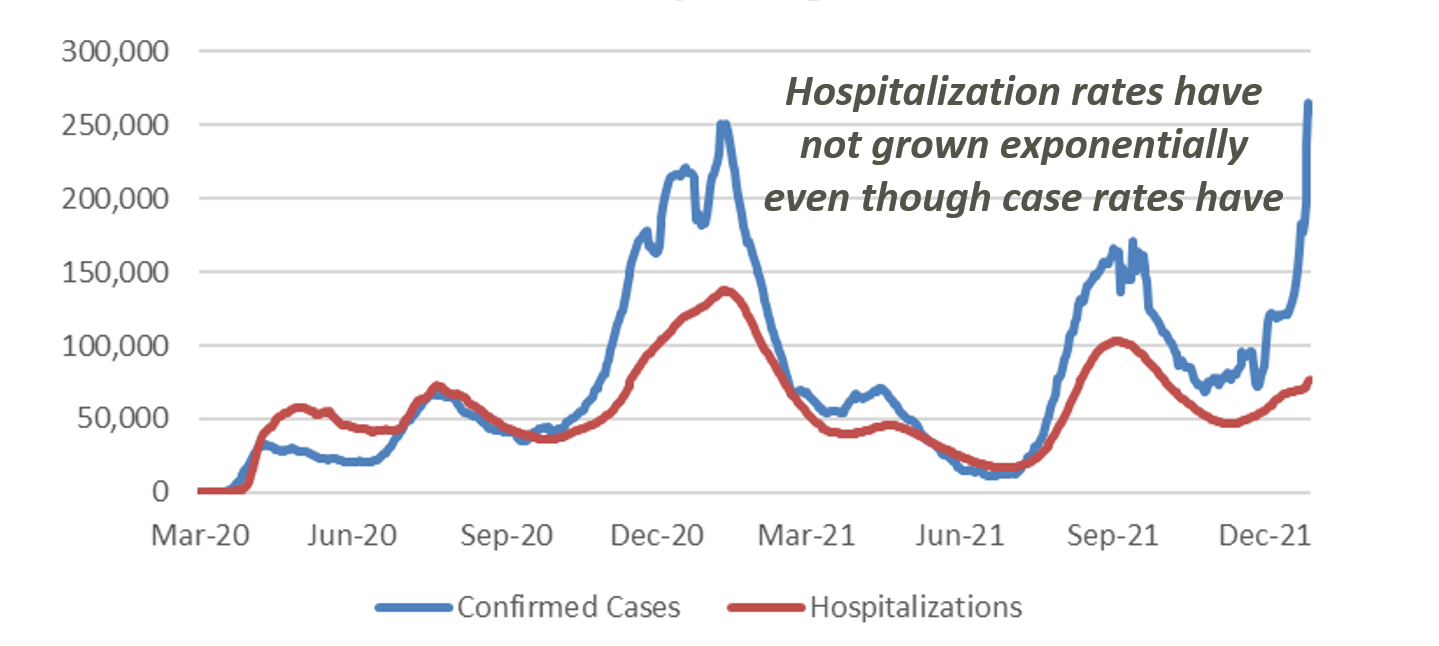

- Despite its explosive growth and quick transmissibility, the omicron variant appears to be less dangerous than previous COVID-19 variant surges.

- While the healthcare system is currently struggling with capacity concerns, current data suggests the following:

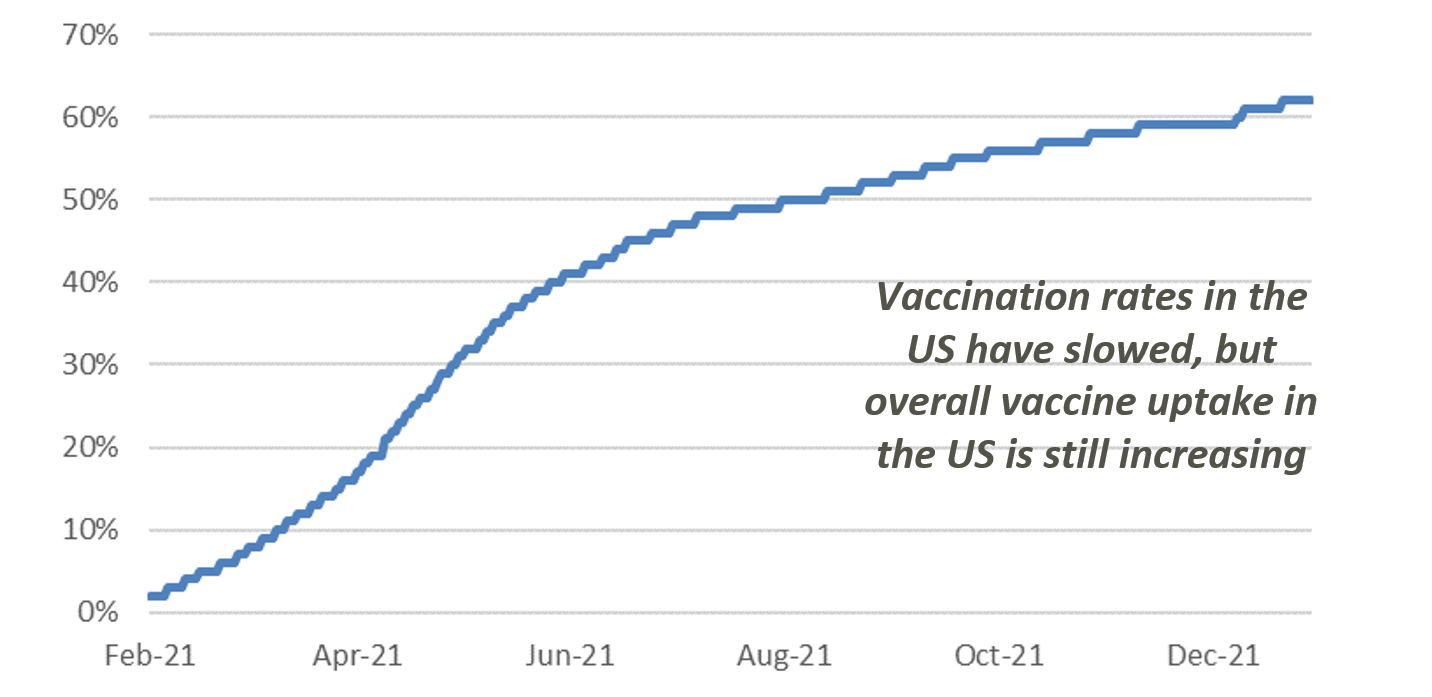

- Vaccinations greatly reduce the potential for severe disease, hospitalizations and death.

- Healthcare professionals have made tremendous progress with treatment procedures and have dramatically improved patient recovery times.

- New, less invasive vaccinations and therapies are likely to continue to hit the market in 2022.

- The combination of infections and vaccinations has the U.S. population getting closer to “herd immunity.”

- Takeaways

- The seriousness of the current or future COVID-19 variants should never be discounted, but the pandemic may show signs of evolution into an endemic in 2022.

- The potential of “economic shutdowns” are lower than they have been since the beginning of the pandemic.

- Freedom of movement and activity will be greatly enhanced in 2022, which should support strong economic growth in 2022.

US COVID Confirmed Cases and Hospitalizations 7 Day Average

Percentage of US Population Fully Vaccinated

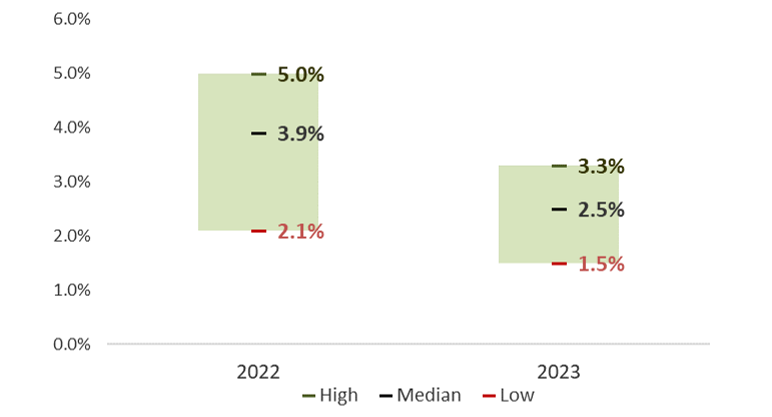

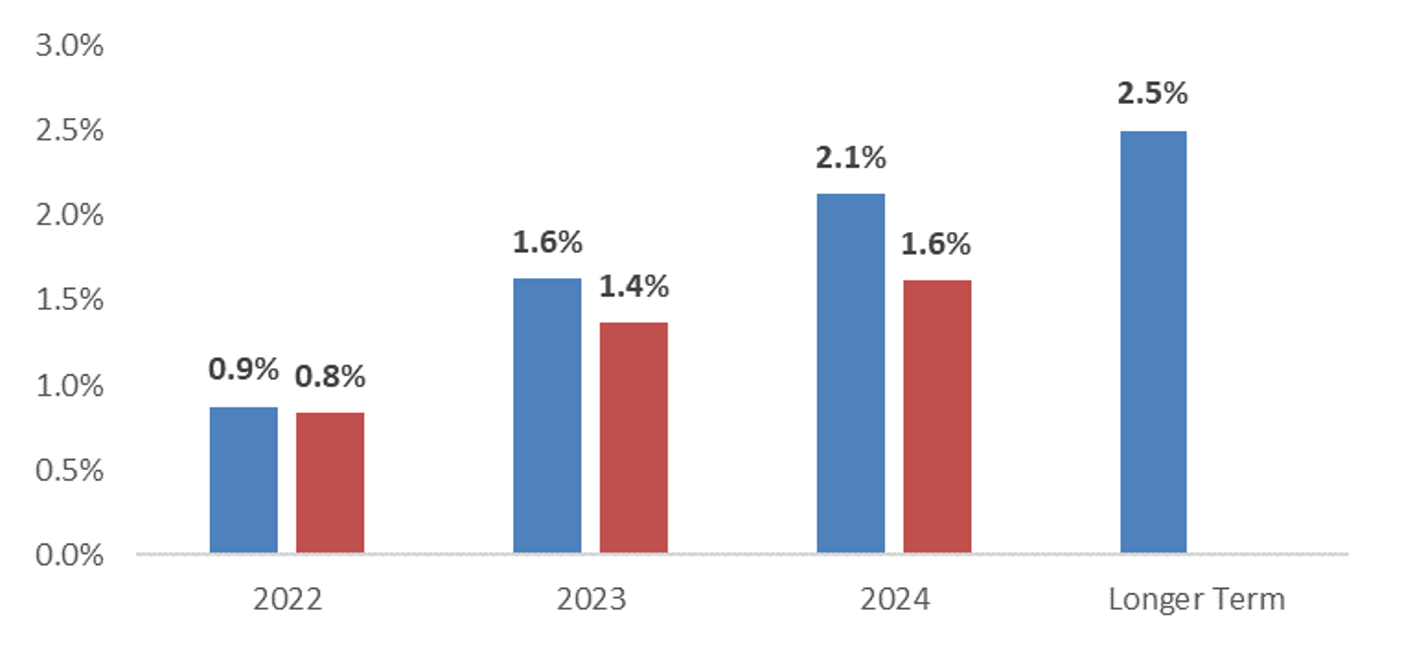

2022 Theme: Decelerating, But Strong Economic Growth

- Following a year of very strong economic growth in 2021, U.S. economic activity is likely to decelerate in 2022.

- In 2021, the U.S. likely hit its peak growth rate in the current economic cycle.

- Despite a moderating growth rate, however, it is likely that economic activity in the U.S. remains well above its long-term trend rate in 2022.

- By the end of 2023, economic growth in the U.S. is expected to be slightly above its long-term trend rate of 2%.

- Takeaways

- The prospect of higher interest rates will likely have a more meaningful impact on future economic growth in the U.S. than any other macroeconomic variable.

- The faster the Fed dials back its accommodative monetary policy, the sooner economic growth slows.

US GDP Growth Projections

2022 Theme: Tighter Monetary Policy

- The Fed uses its monetary policies to achieve its dual mandate of:

- Full employment

- Price stability

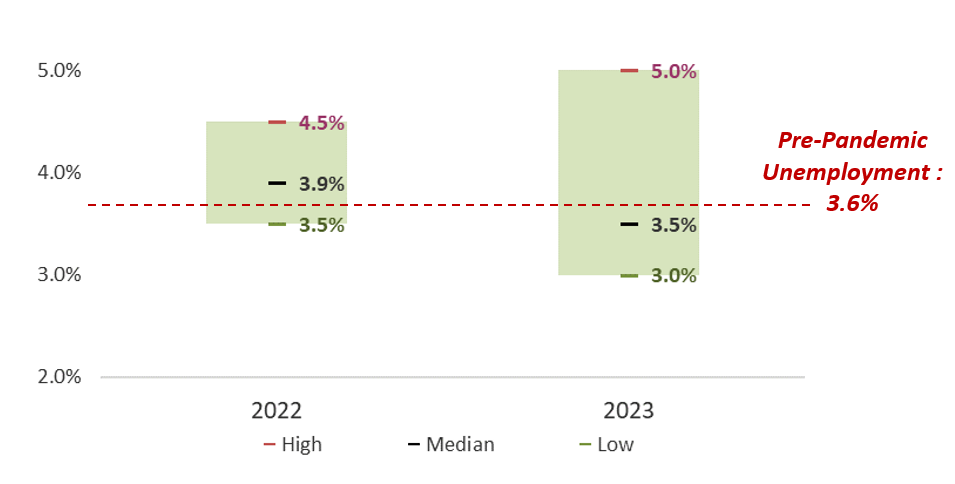

- With inflation running high and unemployment close to pre-pandemic levels, the Fed has plenty of room to tighten monetary policy in 2022.

- Inflationary pressures are expected to moderate in 2022 and return to pre-pandemic levels in 2023.

- Unemployment may return to its pre-pandemic level in 2022.

- Takeaways

- The Fed’s tightening monetary policy will help dampen inflation in 2022, but inflation will remain higher than normal in 2022.

- If the Fed increases the pace of its monetary policy in 2022, inflation may slow more than expected, but it may also result in higher unemployment.

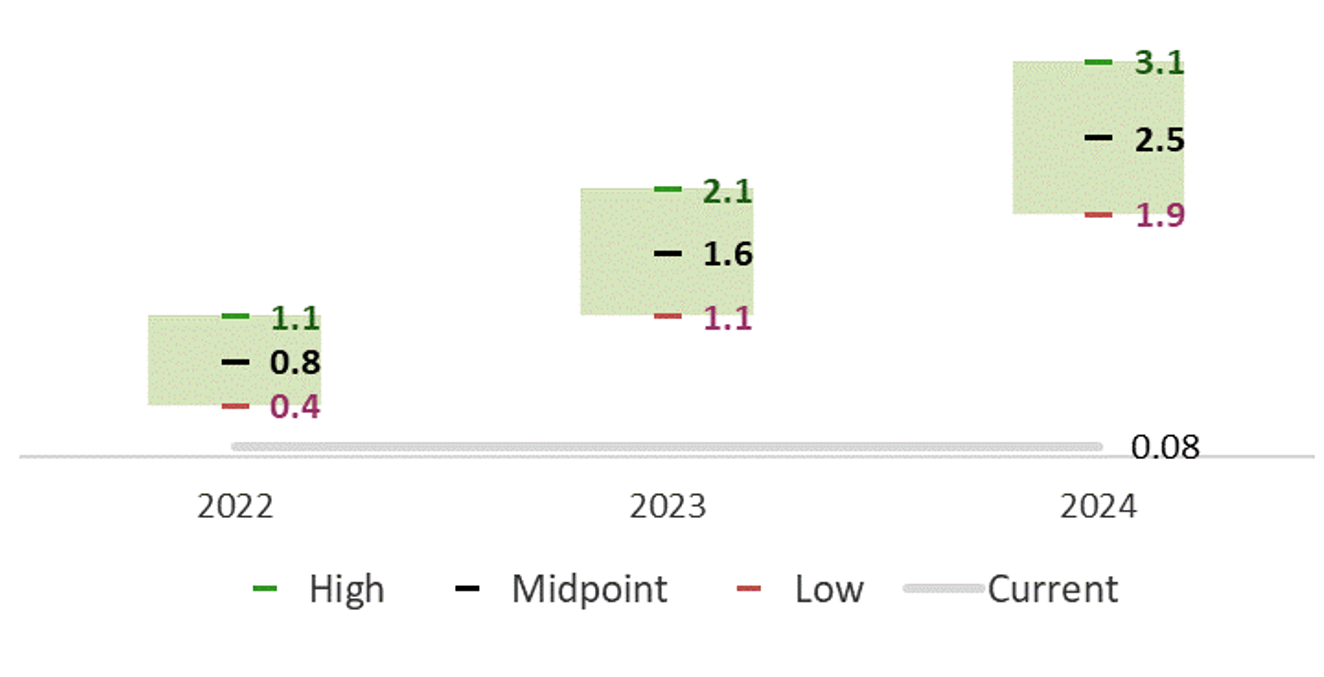

- The Fed has begun its tapering program, reducing its asset purchases initiated at the start of the pandemic.

- The Fed currently expects its tapering program to be completed by March 2022.

- It is also possible that the Fed reduces its balance sheet further by either A. selling, or B. allowing to run off at a controlled pace, assets that were purchased during its Financial Crisis quantitative easing program.

- The Fed’s second step to a tighter monetary policy includes several increases in its short-term policy rate.

- Market participants have currently priced in three rate hikes in 2022, with the initial rate increase expected in March 2022.

- Despite its aggressive tone, the Fed’s current rate hike expectations imply that short-term interest rates will remain below 2% through 2023.

- Takeaways

- Investors should expect that the Fed and market participants will adjust monetary policy expectations as market conditions evolve in 2022.

- Changing market conditions could create a more aggressive monetary policy than currently assumed, but the Fed may elect to reduce its balance sheet further in lieu of increasing the pace of its rate hike cycle.

US Unemployment Rate Projections

Range of US Inflation Projections

FOMC Summary of Economic Projections for the Fed Funds Rate

Projected Fed Funds Rate Target

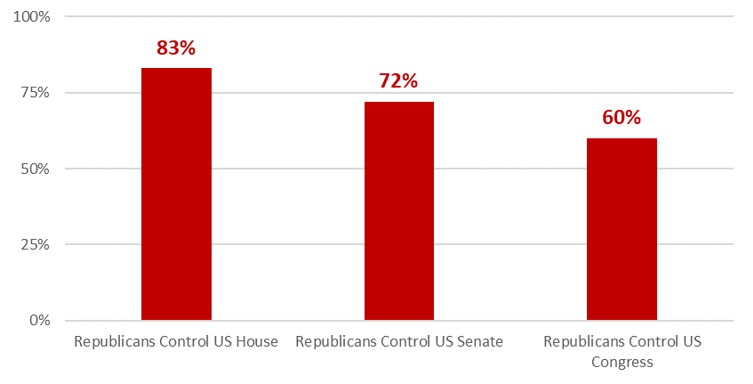

2022 Theme: Midterm Elections

- The lead up to midterm elections is likely to slow legislative progress in 2022.

- A potential deal for “Build Back Better” is running out of time as Washington begins to ramp up for election season.

- The original bill passed by the House in 2021 is “dead” and the “Build Back Better” agenda may be in jeopardy.

- If there is a deal in 2022, the amount of the final spending package will probably be much lower than its original amount and many of the original features will be removed (spending on clean energy infrastructure, tax reform, etc.).

- A potential deal for “Build Back Better” is running out of time as Washington begins to ramp up for election season.

- Polling currently suggests that Republicans are likely to take back leadership in the U.S. House and U.S. Senate.

- Polling at the end of 2021 implied a 60% probability that Republicans have a majority in both houses of U.S. Congress in January 2023.

- Current polling should be considered “noise” and investors should be ready for a long and contentious campaign season.

- Takeaways

- Polling surprises will occur over the next several quarters and any market reaction to new polling trends is likely to be short term in nature.

- Investors should avoid making long-term investment decisions based on changing political headlines.

Probability of Leadership Change Based on Polling Data 12/31/2021

2022 Theme: Geopolitical Noise

- Adversaries view U.S. global leadership as being in a period of “strategic decline.”

- 2022 will likely see more aggressive rhetoric and actions from adversaries, testing the U.S.’s resolve as a global leader.

- Examples include:

- China’s growing influence in the world

- China will continue to build up military and economic resources in the South China Sea in an effort to minimize U.S. power in the region.

- China will continue to place strategic importance on Taiwan and build upon its ability to “reunify” in the future.

- China will continue to grow its sphere of influence westward through economic diplomacy in developing countries.

- China’s focus on technology development will accelerate and create the potential for additional trade conflicts.

- Russia’s aggressive stance in Eastern Europe

- Russia’s build up of troops on the Ukrainian border has created a potential military conflict and humanitarian crisis.

- Despite the aggressive tone, the situation in Ukraine is likely to be handled diplomatically, but the U.S. will need to make concessions to minimize the threat.

- Nuclear proliferation in Iran

- Iran and the U.S. will struggle to find common ground as it relates to the Iranian nuclear program.

- Efforts will be made to find a diplomatic solution to the current impasse, but any progress will be limited in nature.

- China’s growing influence in the world

- Takeaways

- Geopolitical struggles will be challenging for the U.S. to navigate in 2022, but investors should discount the potential of these issues creating major, long-term market disruptions.

- Investors should avoid making long-term investment decisions based on geopolitical headlines.

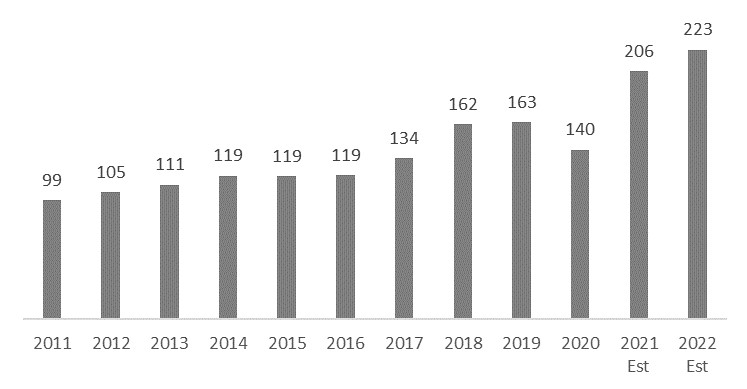

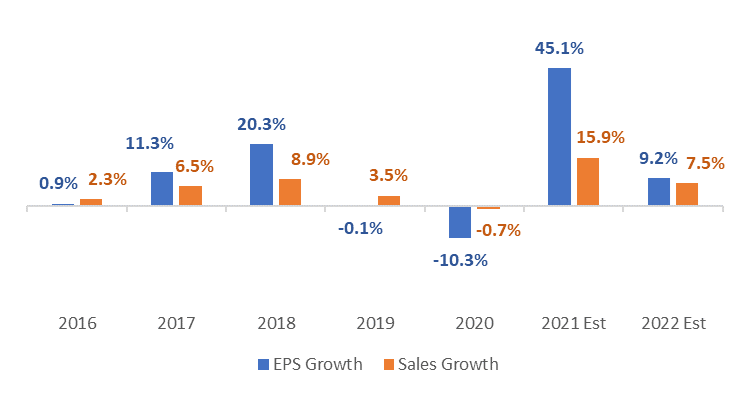

2022 Theme: Decelerating Growth in Corporate Earnings

- U.S. corporate earnings growth in 2021 beat expectations by a very large margin as firms successfully navigated supply chain disruptions, labor shortages and higher inflation.

- Corporate earnings growth was so strong in 2021 that fundamental valuations did not change much despite high equity market returns.

- Current consensus estimates suggest that U.S. corporate earnings growth will decelerate in 2022 but remain above the historical trend rate.

- Corporate earnings are expected to grow by close to 10% in 2022, approximately 40% higher than the historical average of 6%.

- Takeaways

- Persistent supply-chain disruptions and labor shortages could pressure companies’ bottom lines in 2022, but investors should remember that firms successfully navigated these challenges in 2021.

- If the Fed’s monetary policy is more aggressive than currently expected, corporate earnings may come under additional pressure in 2022.

S&P 500 Bottom-Up EPS Actuals & Estimates

S&P 500 Earnings & Revenue Growth

2022 Playbook: US Equity

- Most valuation measures of U.S. stocks continue to look expensive.

- Most fundamental valuations indicate that U.S. Large Cap equities are between 25%-50% more expensive than the historical average.

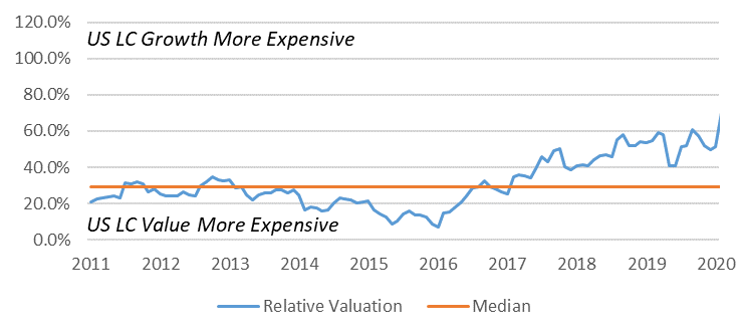

- “Growth” stocks in the U.S. are significantly more expensive than “value” stocks.

- Historically, “value” stocks have tended to outperform “growth” stocks during periods of increasing interest rates.

- Takeaways

- Strong corporate earnings expectations point to positive returns for U.S. stocks in 2022, but high valuations will likely limit the potential upside.

- Investors can improve the risk and return profile of their investment portfolio by reducing any “overweight” to U.S. “growth” stocks

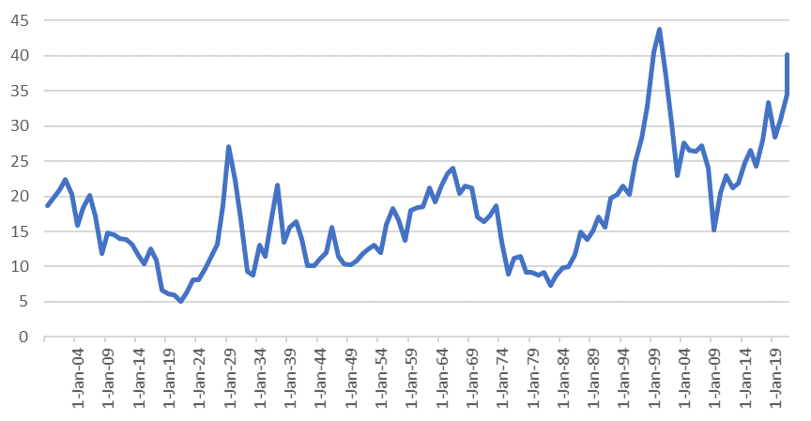

Shiller PE Ratio

Relaive Valuation US Large Cap Growth vs. US Large Cap Value Forward P/E

2022 Playbook: International Equity

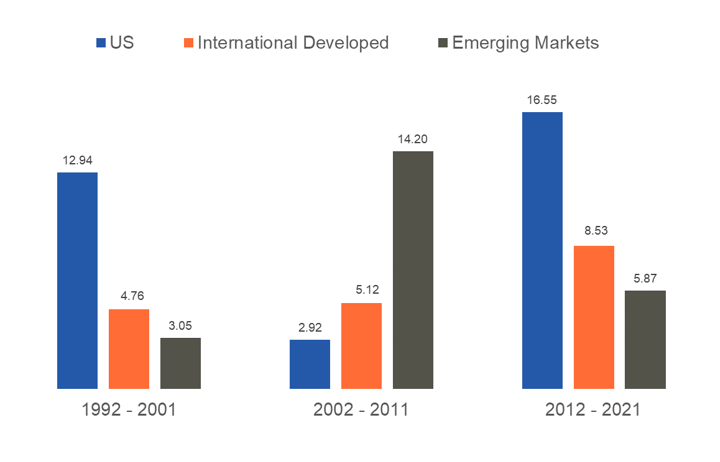

- U.S. investors have benefited from home-country overexposure in the past 10 years.

- Consistent outperformance of the U.S. equity markets is not a natural state and will reverse at some point.

- Historical returns over longer time periods show that return differences between U.S. and international markets are cyclical in nature (the current cycle of U.S. outperformance is the longest ever recorded).

- International and emerging market equities are much cheaper than U.S. equities and have a higher upside as a result.

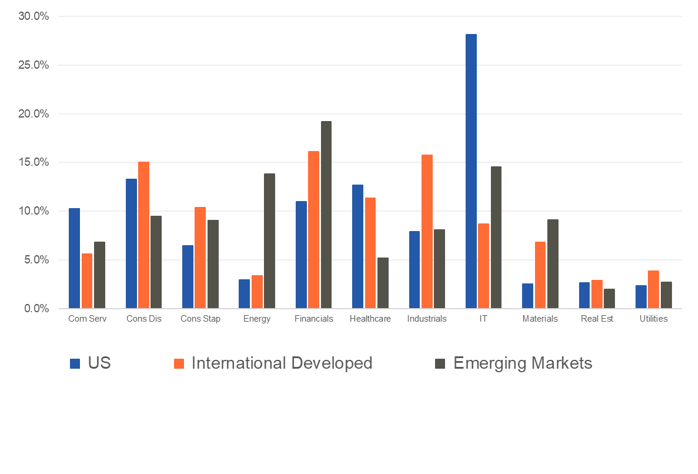

- Additionally, International and Emerging Market equities have a larger weight of “value” stocks than U.S. markets.

- Takeaway

- Investors that shy away from International and Emerging Market equities are likely reducing the upside potential of their investment portfolios.

World Equity Market Performance

World Equity Sector Allocation

World Equity Sector Allocation

2022 Playbook: Fixed Income

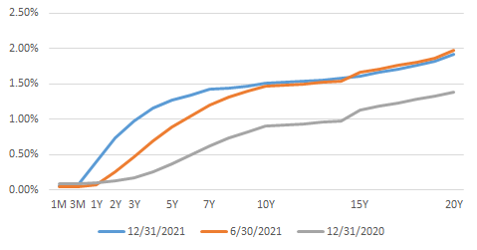

- Treasury yields remain historically low but have moved higher since the end of 2020.

- Short-term interest rates have increased at a greater rate than longer interest rates, creating a “flatter yield curve” entering 2022.

- As the Fed continues its tapering program and considers further reductions in its balance sheet, intermediate and longer date yields are poised to move higher.

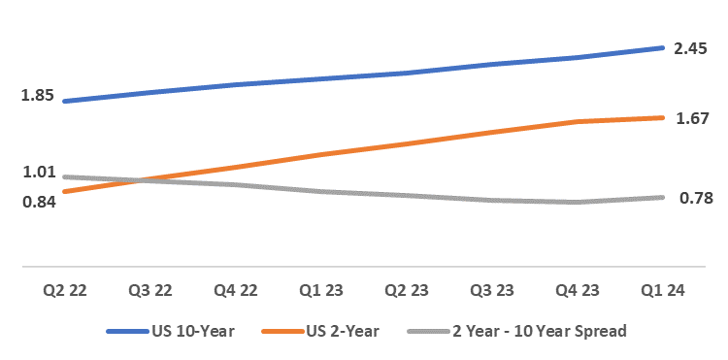

- Fixed income markets currently expect 10-year Treasury Yields to increase 50-75 bps over the next few years.

- Despite the prospect for higher intermediate and long-term interest rates, market participants are pricing in an even flatter yield curve in 2022 and 2023.

- In other words, the market is expecting the Fed’s pace of rate hikes to slow inflation and economic growth over time.

- Takeaway

- Shorter duration fixed income is likely to continue to outperform longer duration fixed income as economic recovery gains momentum.

Treasury Yields

Expected Yields

2022 Playbook: Fixed Income

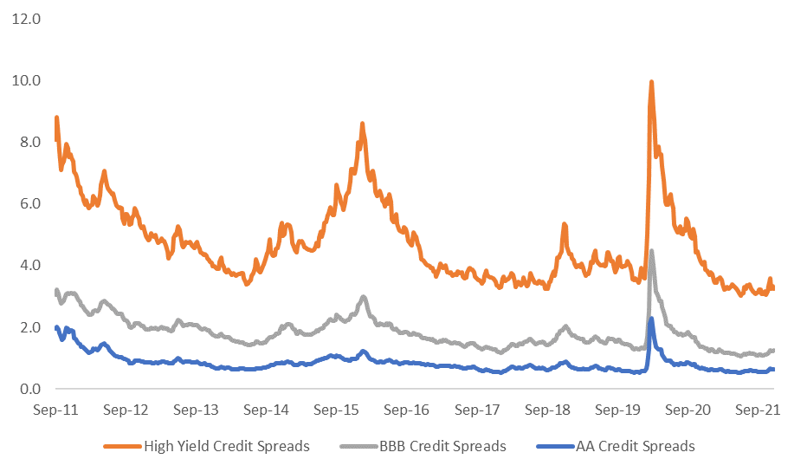

- Corporate credit is historically expensive from a fundamental perspective.

- Regardless of credit quality, Corporate Fixed Income yields spreads are near the tightest on record.

- Corporate bond yield spread is the difference between the yield of a corporate bond and the yield of a Treasury bond of the same maturity.

- The tighter the yield spread, the greater the drawdown risk of corporate bonds.

- Regardless of credit quality, Corporate Fixed Income yields spreads are near the tightest on record.

- Takeaways

- We expect an increase in corporate fixed income market volatility as the Fed tightens monetary policy.

- While corporate bonds are a core holding in any fixed income portfolio, it may be appropriate for investors to reduce their exposure to the riskiest portions of the corporate fixed income market (i.e. High Yield).

US Credit Spreads

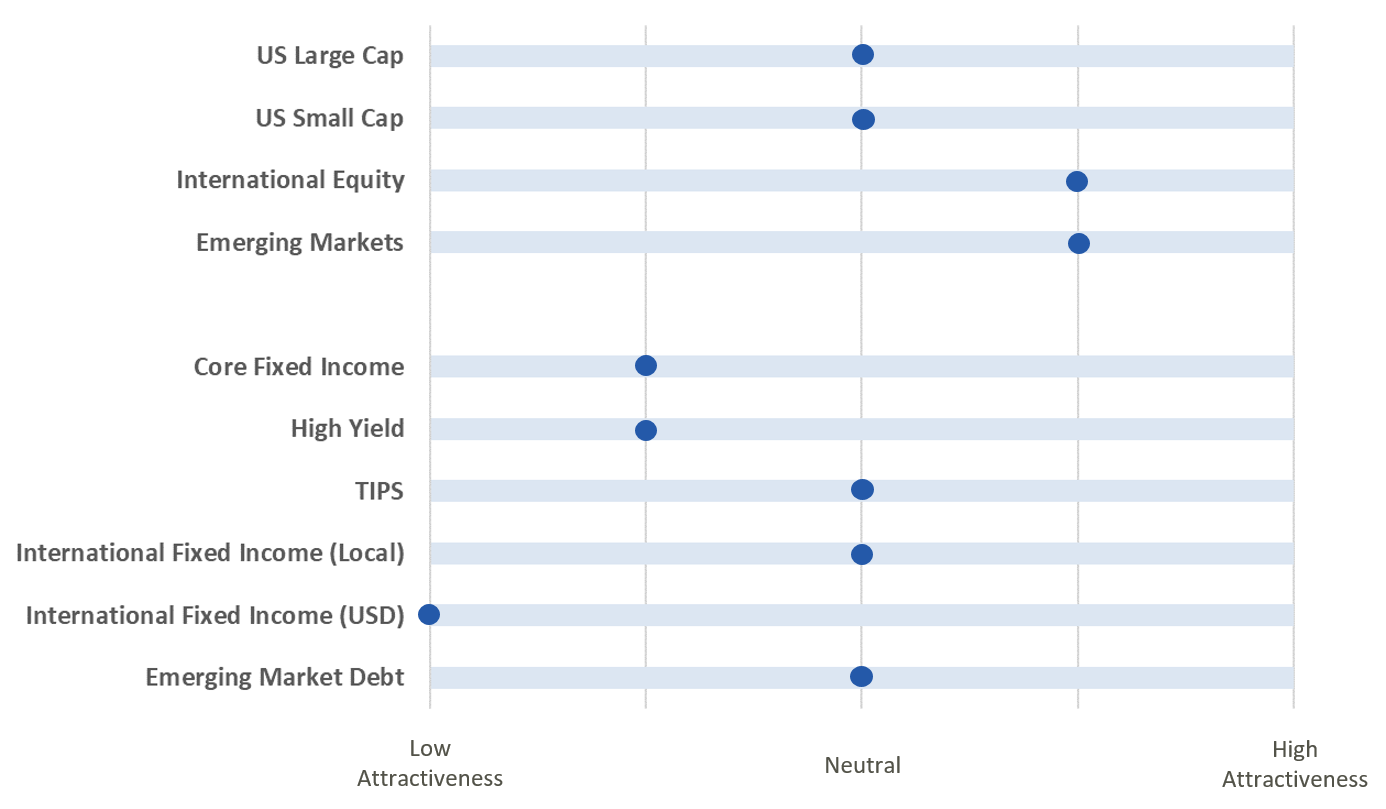

2022 Playbook Summary

- The above table indicates where each major investment asset class falls on the distribution of attractiveness (from low to high). This table is meant to provide a standardized and comparable view of the level of opportunity in each asset class category.

- In subsequent quarters, we will discuss any movement along the scale for each asset class and the driving forces behind the change in outlook.