Themes for Q4 2020

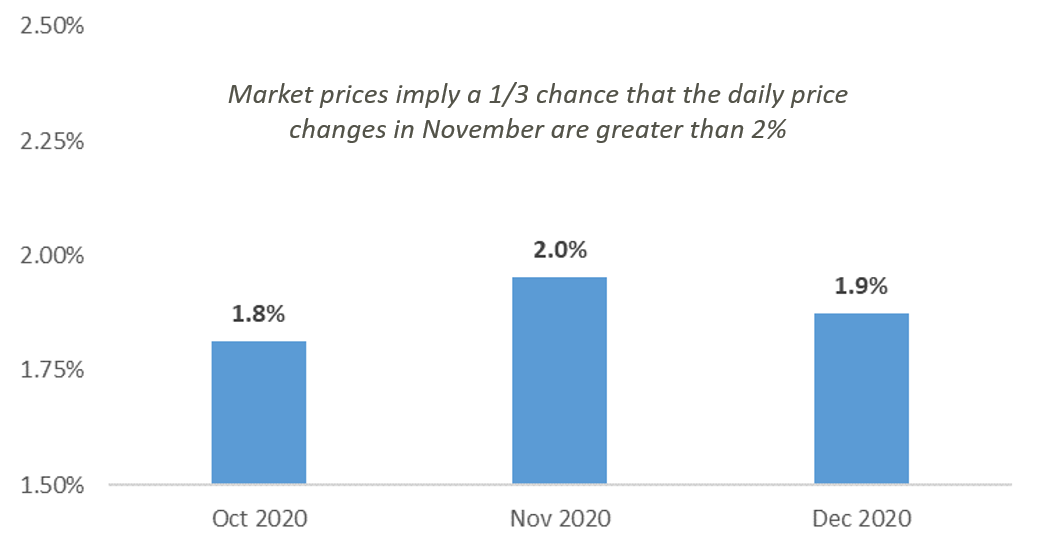

- Despite the strong rebound in equity markets since March 23, uncertainty remains much higher than normal.

- US stocks (and global stocks) have been bid up in recent months as monetary and fiscal stimulus has helped support economic activity.

- Despite the relative improvement in economic growth, the global economy remains far below 2019 levels and will likely not fully recover until a safe and effective vaccine is widely distributed.

- Investors should expect the fourth quarter to be a “bumpy ride” for the following reasons:

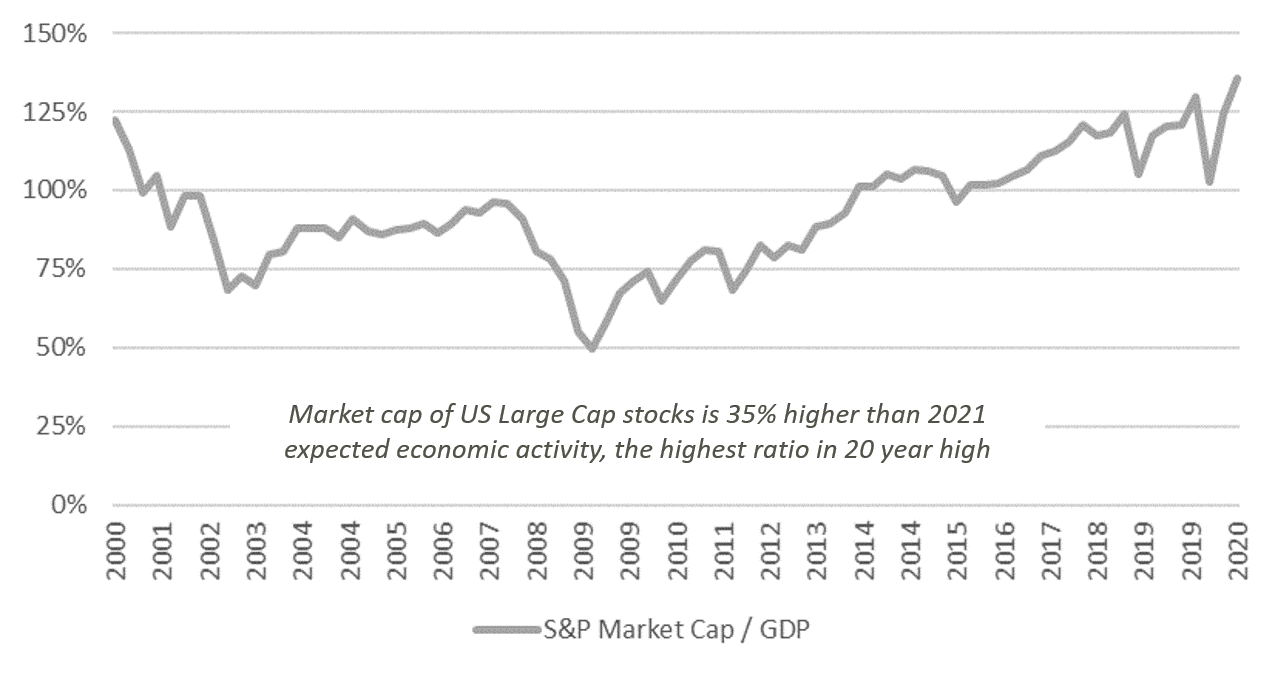

- Fundamental valuations currently imply that equities are “expensive” on a historical basis

- A second wave of COVID infections could result in a slowdown of economic activity.

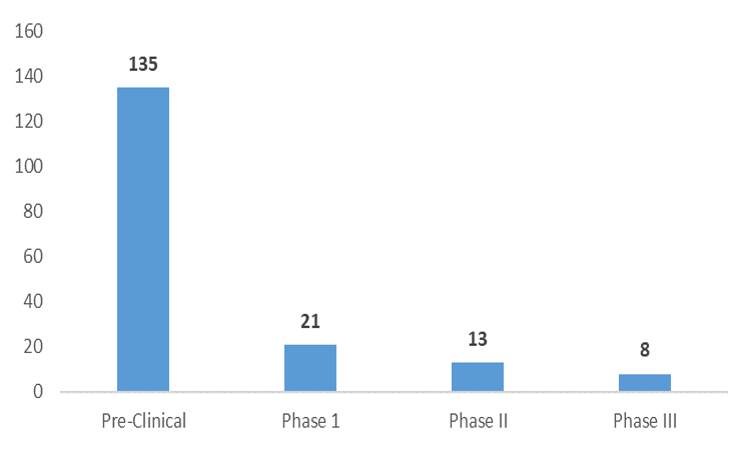

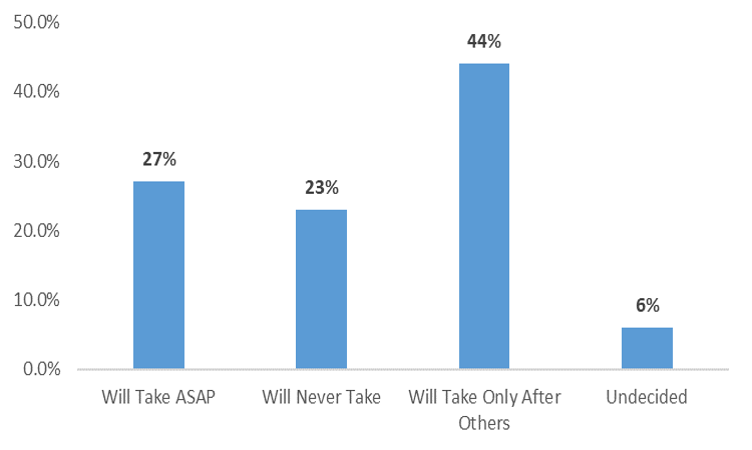

- While experts are confident a vaccine will be available soon, production, delivery, and adoption concerns remain.

- Fiscal stimulus efforts in the US remain “on hold”.

- The general election in the US may result in outcomes that may not be known for weeks following the election.

S&P Market Cap to GDP Ratio

Daily Price Change (1 Standard Deviation)

The Virus and Vaccines

- The US and Global economy will not recover fully until a safe and effective vaccine is widely distributed.

- The good news for markets: Medical professionals and scientists have become more effective in how the disease is treated, reducing the probability of large scale economic shutdowns.

- Some firms that are working on vaccine candidates suggest late stage trial data will be available in this fall, potentially clearing a major hurdle for regulatory approval.

- The bad news for markets:

- As the US enters final months of the year, concerns over a “second wave” of virus growth may require targeted restrictions on economic activity.

- A meaningful percentage of the population may be unwilling to take the vaccine until it is proven to be effective.

- Takeaways:

- The effectiveness of any vaccine may not be known for some time, which is likely to create short term headline risk in capital markets.

Vaccine Candidates Trial Status

Will Americans Take the Vaccine Once It's Available?

Fiscal Stimulus

- Since it will take time for a safe and effective vaccine to be widely distributed, additional fiscal support is needed in the US and abroad.

- The good news for markets:

- It is possible that a small fiscal stimulus bill (airlines) will be passed before the election.

- The Fed has indicated a willingness and ability to provide more monetary stimulus if US Congress cannot agree on another round of fiscal stimulus.

- The bad news for markets:

- In the US, many states, local governments, small businesses, and unemployed workers need fiscal stimulus badly.

- A large stimulus deal appears to be unlikely before the election.

- Takeaways:

- The longer it takes for Congress to pass another round of large fiscal stimulus, the more economic growth may slow and the more volatile the market will be.

General Election

- As of October 1, polls suggest that Joe Biden will win the White House in the general election, but control over Congress is still a “toss up”.

- Note: Investors should remember that polls can be wrong and that election day could bring surprises (see November 2016 election)

- If Democrats win the White House and have the majority in both houses of US Congress, it is likely that current regulatory and tax policies will change in a meaningful way.

- Energy, Technology, Financials, and Health Care industries may be impacted the most through regulatory reform.

- High income earners, corporations, and some investors will likely see higher tax rates once the economy is on more solid ground.

- A split Congress would likely limit the amount of regulatory and tax policy changes.

- Takeaway:

- Although potential changes in leadership may create volatility over the short term, markets will be “re-priced” quickly to incorporate any changes in economic and earnings growth.

Regulatory Impacts If Democrats Control White House and Congress

| Negatively Impacted Sectors/Industries | Positively Impacted Sectors/Industries |

|---|---|

| Energy (Fossil Fuel Based) | Consumer Staples |

| Financials | Communications |

| Health Care | Industrials |

| Technology | Transportation |

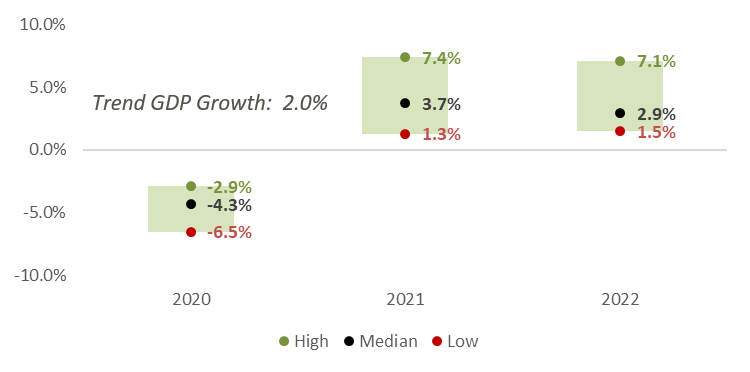

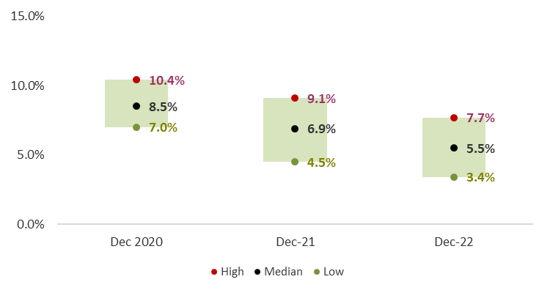

Economic Growth Expectations

- Following a historically poor first half, economic growth picked up substantially in the summer months.

- US economic growth projections for 2021 and 2022 indicate that “above trend” growth is likely.

- Takeaways:

- “Above trend” economic growth will provide a shot in the arm for many of the industries that have struggled in 2020.

- Stronger economic growth could also lead to higher yields on the long end of the yield curve.

Range of US Economic Growth Projections

Real GDP

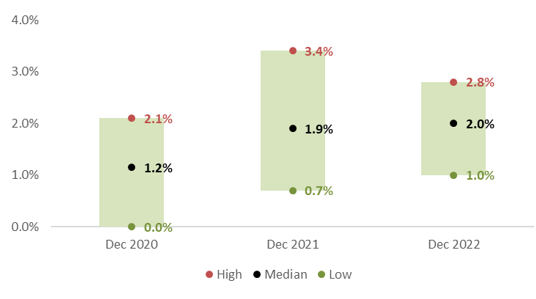

Monetary Policy

- The Federal Reserve’s monetary policy goals are to ensure price stability and full employment.

- Since unemployment remains high and inflation remains below the Fed’s target, monetary policy will likely continue to be accommodative for the next couple of years.

- The Fed has also indicated that it will allow inflation to run above its long term 2% target for some time.

- Takeaways:

- Accommodative monetary policy may eventually lead to above trend inflation, a weaker US dollar, and a steeper yield curve.

- If inflation ticks higher than expected, cyclical industries in the US and international investments may benefit the most.

Range of Projected US Unemployment Rate

Range of US Inflation Projections

Equity Outlook

- US investors have benefited from home-country overexposure in the past 10 years.

- Consistent outperformance of US equity markets is not a natural state.

- Longer time periods show that outperformance rotates between US and international markets.

- US stocks represent less than 60% of the global public equity market.

- International and emerging market assets serve as portfolio diversifier and can provide a source of differentiated returns.

- Takeaways:

- Long term investors should remember that asset classes have periods of relative strength and relative weakness

- US stocks, having been in a position of relative strength since the financial crisis, may fall out of favor if global economic growth improves.

World Equity Market Indexes % Performance

- Despite the short term headwinds that markets currently face, long term investors should use any market volatility as an opportunity to add to risky asset classes that have struggled on a relative basis in years past.

- High quality stocks are likely to outperform most stocks during periods of short term volatility, but will likely underperform once the prospects for economic growth become less uncertain.

- Examples of asset classes that look “cheap” on a relative valuation basis and might outperform during a more certain economic environment:

- Value stocks (ex: financials) may be poised to outperform growth stocks (ex: technology).

- Small Cap may outperform Large Cap.

- International Equity and Emerging Markets Equity may outperform US Equity.

Relative Valuation

US Large Cap Growth vs US Large Cap Value

Forward P/E

Relative Valuation

US Large Cap vs International Large Cap

Forward P/E

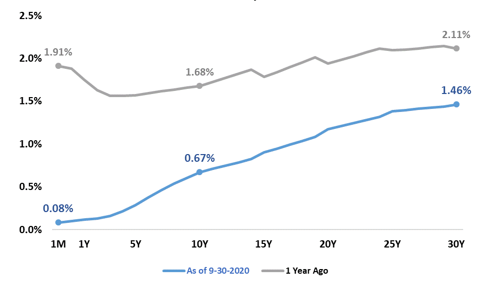

Fixed Income Outlook

- US Treasury yields have dropped over the past year as a result of Federal Reserve monetary policy intervention and investor “flight to quality”.

- Across most fixed income asset classes, yields are significantly lower than they have been in the past.

- Takeaways:

- Investors should expect lower yields, particularly on the short end of the yield curve, for the foreseeable future.

US Treasury Yields

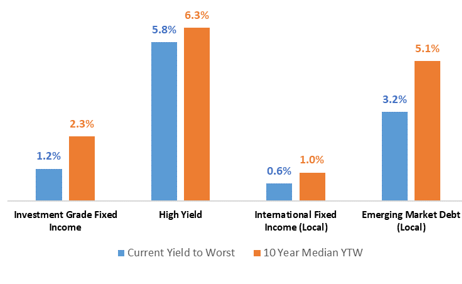

Fixed Income Yield to Worst

- Long term fixed income investors are likely to see low yields for the next few years as central banks across the globe remain committed to providing support to local economies.

- Although there are opportunities to pick up additional yield, it does come with higher amounts of credit risk.

- Example: High yield bonds are currently yielding about 5% more than the 10-year US Treasury.

- Potential downfalls of adding high yield bonds (or adding credit risk):

- High yield bonds are highly correlated with equity markets during periods of equity market volatility.

- High yield bond issuers are at a greater probability of defaulting on principal and interest payments.

- If global economic growth falters, high yield bond investors could potentially suffer principal loss.

- Fixed income investors do have lower risk options to enhance total return in the fixed income portfolio:

- Investors should consider that monetary stimulus in the US may eventually lead to higher inflation and a weaker US dollar.

- Fixed income asset classes that are expected to outperform during periods of dollar weakness and higher than expected inflation:

- International Fixed Income

- Emerging Market Debt

- Inflation Protected Securities (TIPS)

- Fixed income asset classes that are expected to outperform during periods of dollar weakness and higher than expected inflation:

- Investors should consider that monetary stimulus in the US may eventually lead to higher inflation and a weaker US dollar.

Summary

- Markets are likely to remain volatile as a number of uncertainties weigh on consumer and business confidence.

- A widely distributed, safe, and effective vaccine is likely to be the most significant catalyst for stronger economic growth.

- In the short term, markets will continue to place emphasis on the potential for additional fiscal stimulus.

- The general election in the US is likely to create significant headline risk in the lead up to November, but short term volatility should be viewed as an opportunity for long term investors.

- Monetary policy across the globe will continue to be accommodative even as the global economy recovers, potentially boosting demand for asset classes that have underperformed since the financial crisis.

- US Large cap growth stocks look particularly expensive relative to every major equity asset class.

- Value, International and Emerging Market equites are most likely to outperform during a period of above trend economic growth.

- Fixed income yields are significantly lower than they have been over the past 10 years.

- Inflation and economic growth expectations may increase yields on the long end of the yield curve, but short term yields will remain very low until monetary policy becomes less accommodative.

- Investors looking for higher total return should consider adding International Fixed Income, Emerging Market Debt, and TIPS to the fixed income portfolio.