Market Flash Report | April 2021

Economic Highlights

United States

- The U.S. economy surged higher during Q1 with 6.4% GDP growth. This was slightly below expectations, but up from Q4’s 4.3% growth. Consumers, who account for 68.2% of the economy, accelerated spending by 10.7% in Q1 compared with a 2.3% increase in the previous period. Business spending picked up in Q1, but trade and inventories were a drag on growth.

- After hitting record highs in March, the ISM Manufacturing PMI and Services PMI softened a bit. They both remain at very strong levels (above 60) , suggesting that the economic boom across the country will continue. New orders and production weakened a bit across manufacturing and services, but a real concern has been the spike in prices, suggesting inflation is on the horizon.

- Inflation expectations continue to surge across the U.S. with breakeven rates trending higher over all time periods. Inflation will naturally rise due to low Y/Y comparisons, but the Fed expects the impact to be transitory. We do not expect to see runaway inflation any time soon, but some closely watched data points suggest there is risk to the upside. The rise in interest rates has been for the right reasons of stronger growth and higher inflation.

Non-U.S. Developed

- The euro zone economy contracted in Q1 2021 as countries implemented new lockdowns and restrictions amid a third wave of coronavirus infections. GDP fell 0.6% Q/Q with weakness in Germany, Italy, Spain and Portugal. France bucked the trend with surprise growth of 0.4%. The Q1 weakness was largely expected with the eurozone’s botched vaccine rollout, but recent data suggest a strong rebound in Q2.

- The eurozone composite PMI moved higher in April, boosted by a pickup in activity across manufacturing and services. April’s

reading of 53.8 was up from 53.2 in March. Activity picked up in Spain and France while it slowed slightly in Germany and Italy. - The U.K. economy should see a strong bounce in Q1 and 2021 as the country has done a nice job vaccinating its population and reopening its economy. Economists have been revising 2021 U.K. GDP growth expectations higher to current levels of 6.5-7%.

Emerging Markets

- The Chinese economy grew at an annualized rate of 18.3% during Q1 2021. That was slightly below expectations and growth slowed a bit Q/Q. Industrial production missed expectations last month while retail sales came in better than expected at +34%.

- We believe the EM growth story is still in tact, but the timing of the economic and earnings recovery in certain countries is still unknown. Two of the larger EM countries, India and Brazil, are in the midst of a crisis dealing with COVID. The rollout of vaccines has also been slower across EMs, potentially delaying the reopening of certain economies.

- Asia has largely weathered the storm in terms of COVID so we expect those countries to drive EM growth in 2021. China represents a huge part of the benchmark so EM performance will largely be driven by Chinese stock performance. Taiwan, Korea, Indonesia, Thailand and India are other big components of EM Asia.

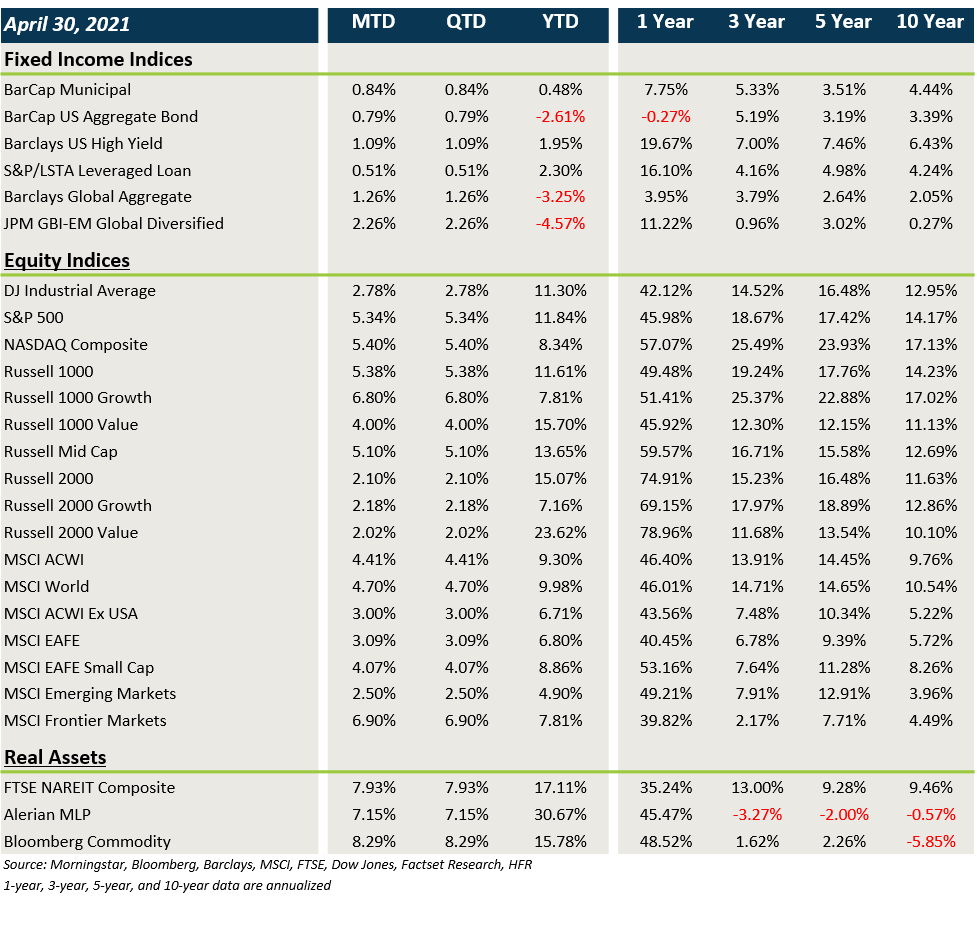

Market Performance (as of 4/30/21)

Fixed Income

- Treasury/sovereign debt yields trended lower in April, leading to gains in core fixed income, munis and sovereign debt. Credit spreads grinded tighter last month leading to gains in HY and floating rate loans. USD weakness also boosted non-U.S. asset prices.

U.S. Equities

- U.S. equities posted strong gains in April led by large caps and growth stocks.

- After outperforming for most of the year, small caps finally underperformed large caps in April.

- Growth beat value, especially across large caps last month, but value continues to lead the way in 2021.

Non-U.S. Equities

- Non-U.S. equities generated solid gains in April, led by strong performance from Europe and growth stocks.

Japan was a notable underperformer last month. - Unlike what occurred in the U.S., small caps in developed and emerging markets beat large caps in April.

- The weaker U.S. dollar boosted non-

U.S. returns. It contributed 175 bps for the MSCI EAFE Index and 88 bps in emerging markets.

Sector Performance

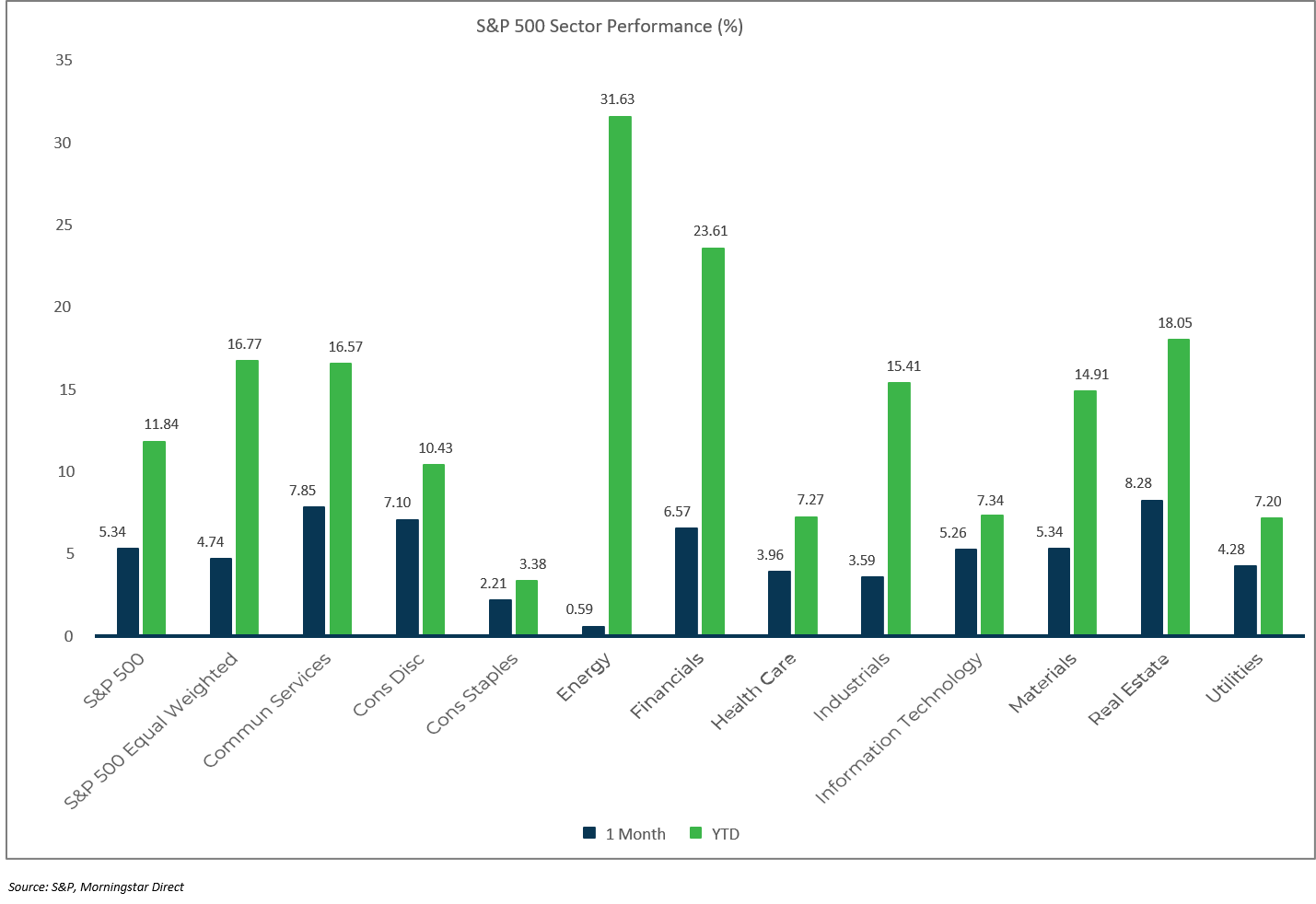

S&P 500 (as of April 30, 2021)

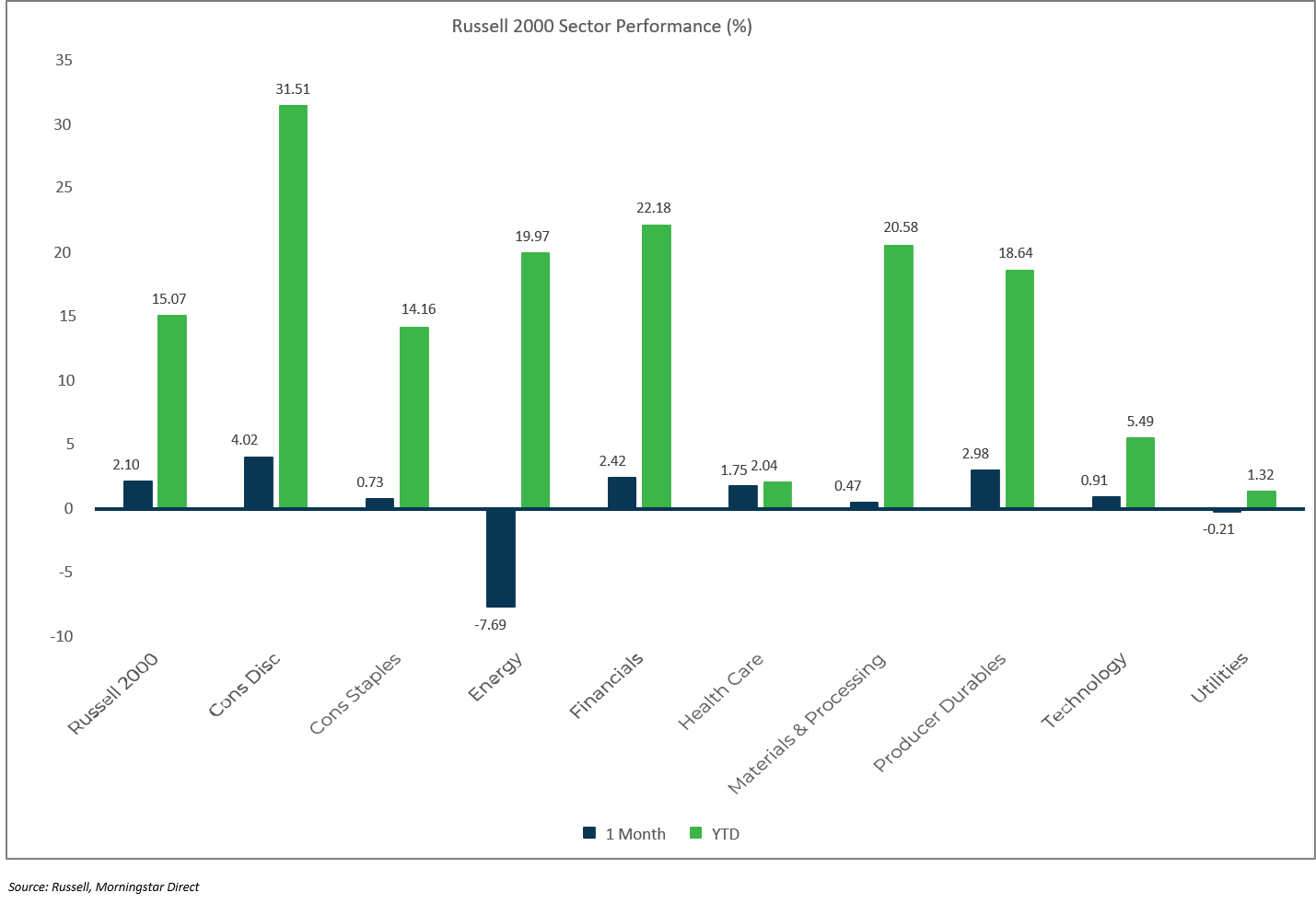

Russell 2000 (as of April 30, 2021)

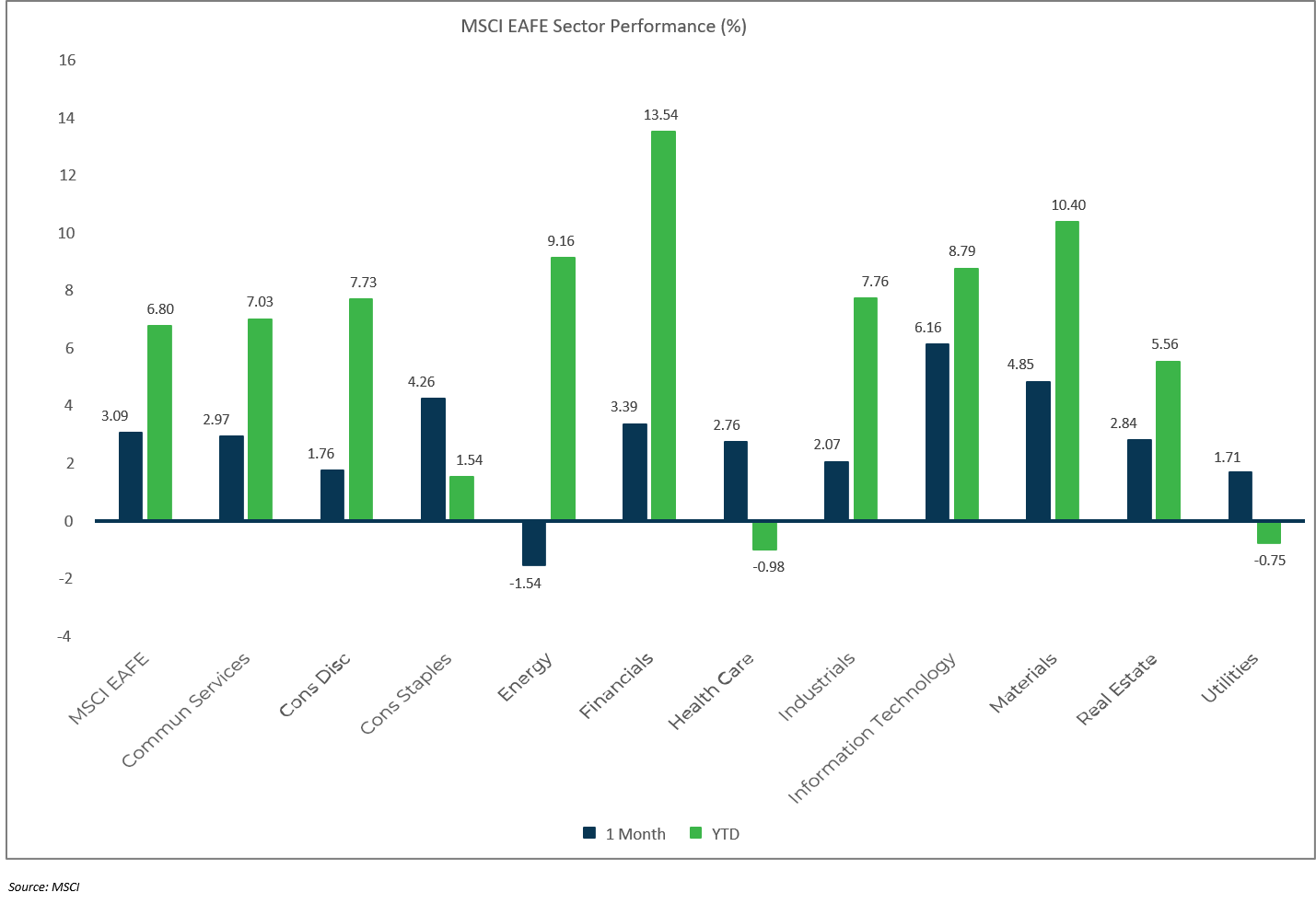

MSCI EAFE (as of April 30, 2021)

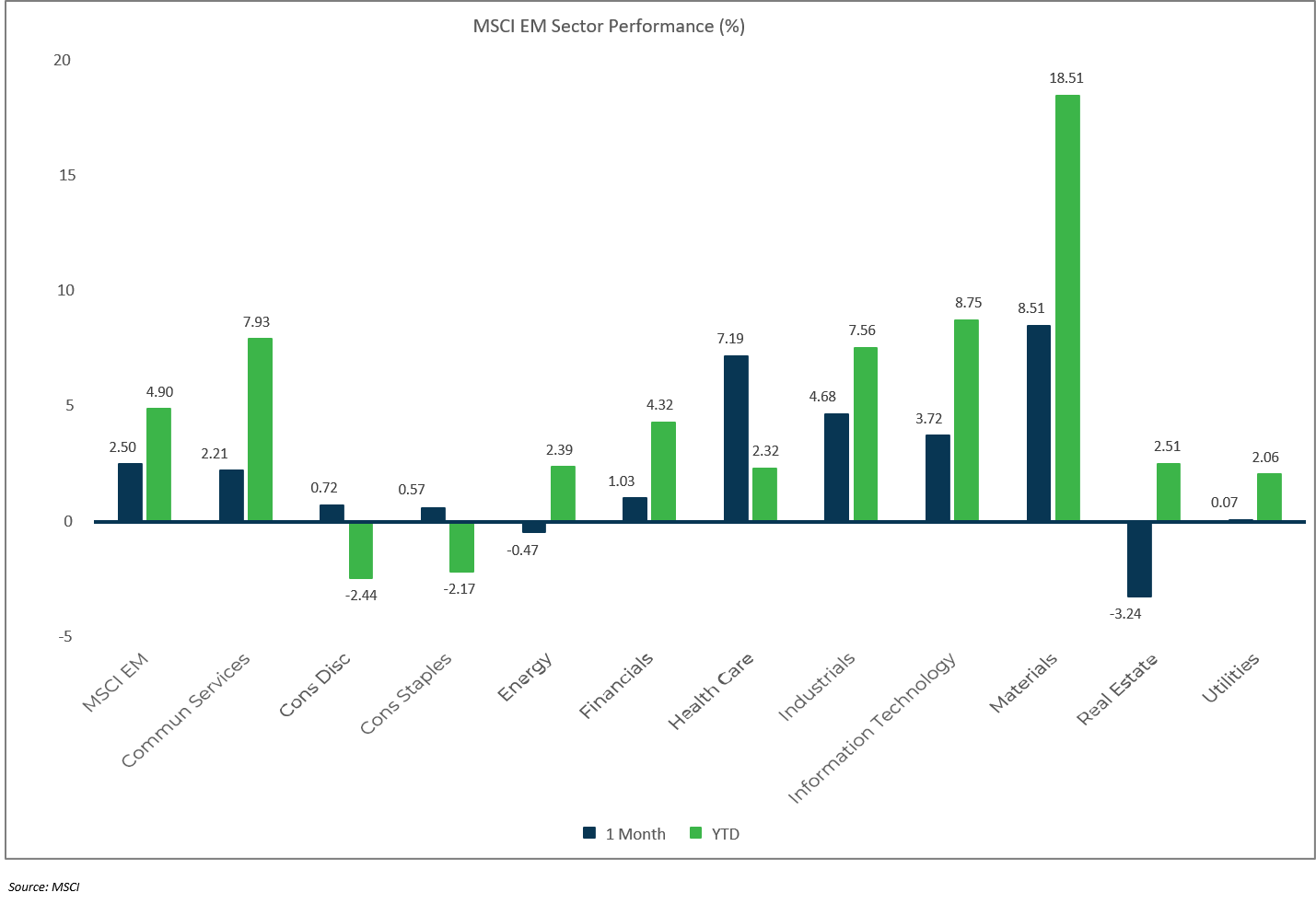

MSCI EM (as of April 30, 2021)